How to Read Your Life Insurance Policy

Reviewed by

Paige Geisler

Licensed Insurance Agent

Reviewed by

Paige Geisler

Licensed Insurance Agent

Table of Contents

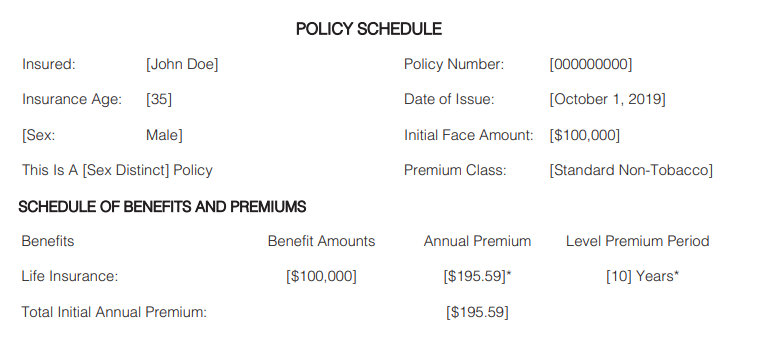

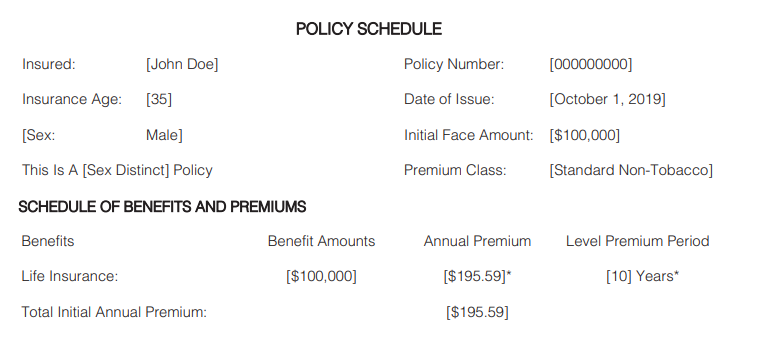

The policy schedule is a document that outlines the key details of a life insurance policy, including the policy term, the amount of coverage, the premiums, and the beneficiaries. The policy schedule is typically included as the first page of the policy and will show you key details about your policy. Be sure to verify all details are correct.

Example of a schedule included in a life insurance policy

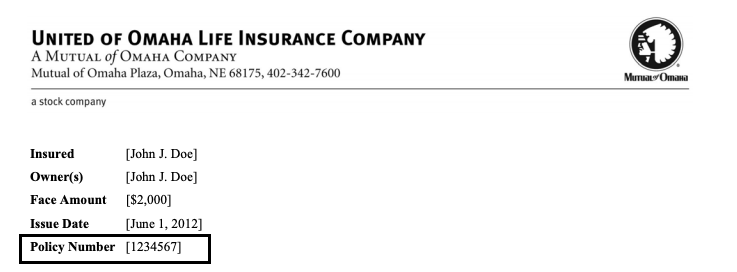

The policy number is one of the most important pieces of the policy schedule and is typically found on the first page. It is important to keep your policy number handy, as you may need to refer to it when making changes to your policy or filing a claim.

Be sure to find your policy number; it will be used if you need to make changes or file a claim

The policy schedule will also include important contact details of the insurance provider. Be sure to locate the customer support number, usually found at the top of the first page. If you call with questions about your life insurance policy (for yourself or a loved one), you will need to know the policy number, the policy owner and provide the insured’s name. These details are often used to validate the policy information.

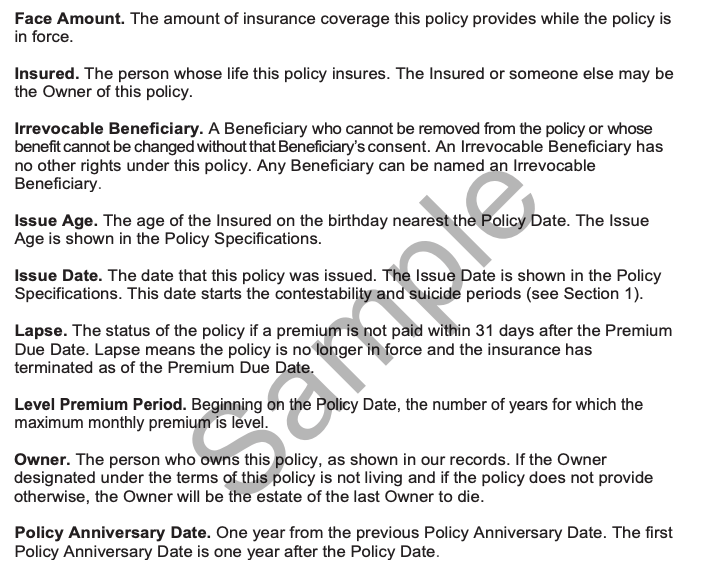

Next, you’ll want to spend time reviewing the definitions of the policy.

The definitions explain key policy terms in plain language. Life insurance policies in their entirety can seem confusing, but the listed definitions will help you decipher exactly what the insurance company is communicating in the policy language.

Some common definitions found in a life insurance policy include:

Example of definitions included in a life insurance policy

These are just some of the common definitions found in a life insurance policy. Other terms and definitions may vary depending on the specific policy and the insurer. It’s important to carefully review your policy and understand all of the terms and conditions before purchasing a life insurance policy.

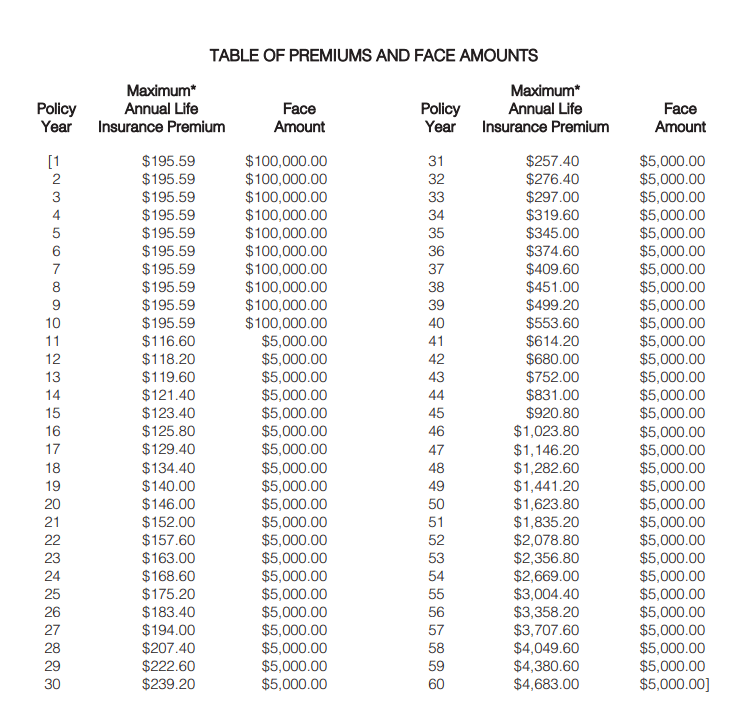

Next, you’ll read into the policy’s premiums.

In the premiums section, you’ll find information that governs how and when you make payments, the right to change your premium, the grace period of the policy, and reinstatement rules. It will also explain whether your premiums are fixed or variable. If it’s the latter, you can find out how premiums change over time.

Example of a table of premiums included in a life insurance policy

The payment terms of a life insurance policy refer to the frequency and method of premium payment. Most life insurance policies require the policyholder to make regular premium payments in order to keep the policy in force. The payment terms will specify the frequency of these payments, such as monthly, quarterly, or annually.

The payment terms will also specify the method of payment. This may include paying by check, credit or debit card, or automatic bank draft. Some insurers may also offer the option to pay premiums online or through a mobile app.

The payment terms of a life insurance policy are typically set at the time the policy is purchased and cannot be changed during the policy term. It’s important to carefully review the payment terms and select a frequency and method of payment that works best for your financial situation.

The right to change is a common feature of many life insurance policies that allows the policyholder to make certain changes to their policy during the policy term. This may include making changes to the policy’s beneficiaries, the amount of coverage, or the premium payment schedule.

The right to change is intended to give the policyholder flexibility and control over their life insurance policy. It allows them to make adjustments to the policy as their needs and circumstances change over time. For example, if the policyholder gets married or has a child, they may want to add their spouse or child as a beneficiary to the policy. Or, if the policyholder experiences a significant change in income, they may want to adjust the amount of coverage or the premium payment schedule to reflect their new financial situation.

A grace period is a specified period of time after the premium payment due date during which the policyholder can still make the premium payment without lapsing the policy. The grace period is typically included in life insurance policies as a way to give the policyholder some flexibility and leeway if they are unable to make a premium payment on time.

The length of the grace period will vary depending on the policy and the insurer. It’s typically between 10 and 30 days, but some policies may have longer or shorter grace periods. During the grace period, the policy is still in force and the coverage remains active. However, if the premium is not paid by the end of the grace period, the policy will lapse and the coverage will be terminated.

It’s important to note that the grace period is not an extension of the premium payment due date. It’s simply a period of time during which the policyholder can make the payment without lapsing the policy. If the policyholder is unable to make the payment by the end of the grace period, the policy will lapse and the coverage will be terminated.

The reinstatement rules explain if, how, and when the company will reinstate your policy after it’s terminated. Some contracts allow you to reinstate if the policy lapses due to nonpayment, but not for any other reason. Look for the reinstatement requirements, which may be different depending on the age of the policy. They might include:

Following the premium section is information about the policy’s benefits and beneficiary designation.

The benefits section of a life insurance policy outlines the specific protections and benefits provided by the policy. This will include the death benefit, which is the amount of money payable to the designated beneficiary or beneficiaries upon the death of the insured person. The benefits section may also include other protections, such as living benefits or accelerated death benefits, which provide for the payment of benefits to the policyholder or beneficiary while the insured person is still alive.

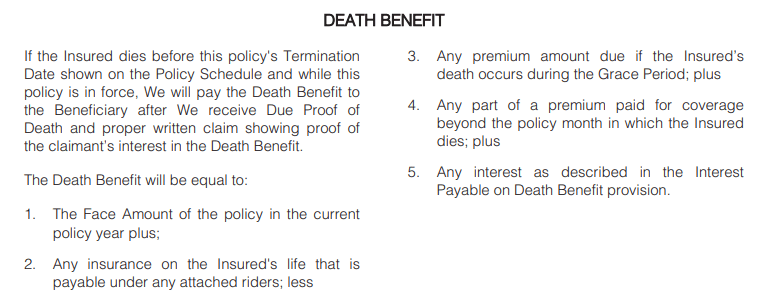

Example of the initial face amount included in the policy schedule

The death benefit is the amount of money that will be paid to the designated beneficiary or beneficiaries upon the death of the insured person. This amount is specified in the policy, and is typically referred to as the initial face amount.

Example of the death benefit section included in a life insurance policy

The death benefit is the primary purpose of a life insurance policy, and is intended to provide financial protection for the policyholder’s loved ones in the event of the policyholder’s death. The death benefit can be used to cover a wide range of expenses, such as funeral costs, outstanding debts, and other financial obligations.

The death benefit is typically paid out to the beneficiary tax-free, which can help to alleviate some of the financial burden associated with the loss of the policyholder. However, it’s important to note that the death benefit may be subject to certain limitations or exclusions, depending on the specific terms of the policy.

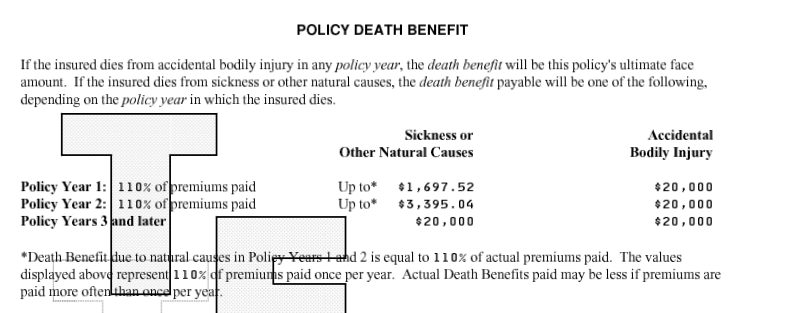

Modified or graded death benefits are options that may be available on certain types of life insurance policies, typically those that are designed to cover individuals with certain health conditions or disabilities. With a modified or graded death benefit, the death benefit paid out by the policy is not the full amount of the coverage, but rather a percentage of the full amount.

Example of a graded death benefit section included in a life insurance policy

For example, if a policy has a modified death benefit of 50%, the policy would pay out 50% of the death benefit if the policyholder dies within the first year of the policy’s coverage. If the policyholder dies after the first year, the policy would pay out the full death benefit.

Modified or graded death benefits can be a useful option for individuals who may not qualify for traditional life insurance coverage due to health issues or other factors that may make them a higher risk. By offering a reduced death benefit initially, the insurer is able to offer coverage to individuals who may not otherwise be eligible, while still protecting the policyholder’s loved ones with some financial support in the event of their death.

The living benefits section of a life insurance policy outlines the benefits that may be payable to the policyholder or beneficiary while the insured person is still alive. These benefits are also known as “accelerated” benefits, because they are paid before the insured person’s death.

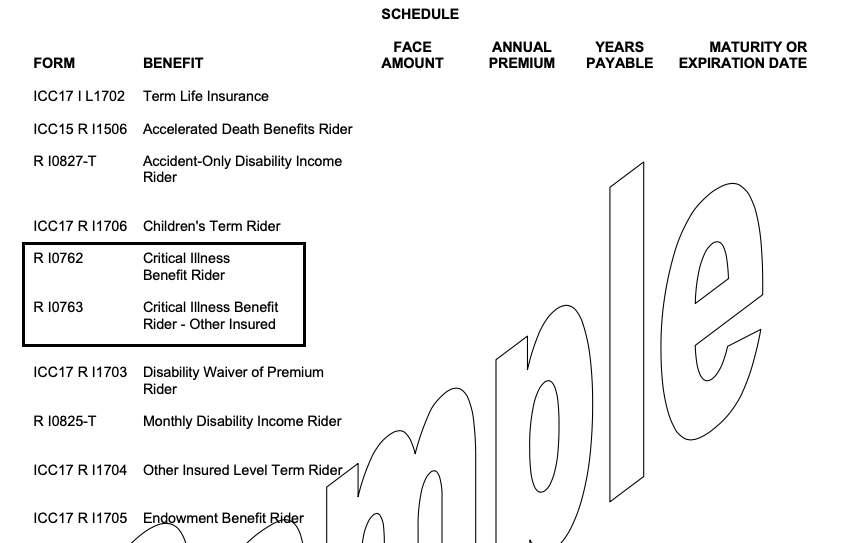

Example of critical illness benefits on a policy schedule

Below are the common living benefits you’ll see on a life insurance policy:

Learn more about living benefits here: https://www.insurancy.com/life-insurance/living-benefits-life-insurance/

The specific conditions and triggers for payment of living benefits will vary depending on the policy and the insurer. Some policies may require the insured person to be diagnosed with a terminal illness and have a life expectancy of less than a certain number of months in order to qualify for living benefits. Other policies may have different triggers for payment of living benefits.

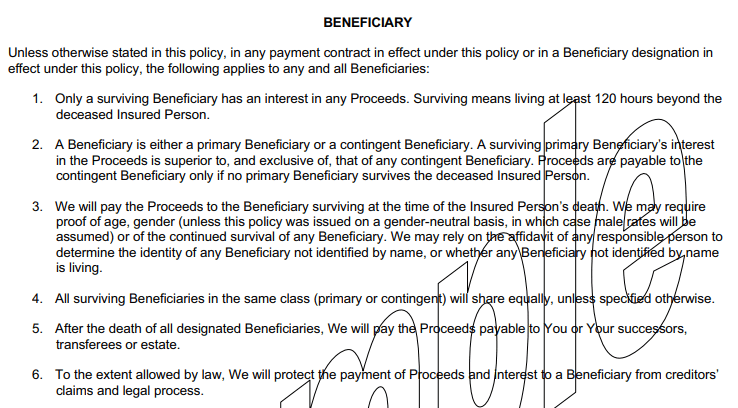

The beneficiary section of a life insurance policy specifies the person or persons who will receive the death benefit upon the death of the insured person. The beneficiary can be an individual, a group of individuals, or an entity such as a trust or a charitable organization.

Example of the beneficiary section included in a life insurance policy

The policyholder has the right to designate the beneficiary or beneficiaries of the policy. This can be done at the time the policy is purchased and can be changed at any time during the policy term by the policyholder. It’s important to carefully consider who you want to designate as the beneficiary or beneficiaries of your policy and make sure that the beneficiary designation is up to date.

The beneficiary designation can have significant financial and legal implications, so it’s important to carefully review the beneficiary section of your policy and make sure that it accurately reflects your wishes.

You will typically find the payment of proceeds as a subsection of the beneficiary information. This outlines the process for payment of the death benefit to the designated beneficiary or beneficiaries upon the death of the insured person. This section typically includes information about the required documentation for filing a claim, the process for submitting a claim, and the timeframe for receiving the death benefit.

The beneficiary payment options subsection specifies the options available to the beneficiary for receiving the death benefit. This may include receiving the death benefit as a lump sum, receiving the benefit in installments, or electing to receive the benefit through a trust or other arrangement.

This section may also include information about the tax implications of the death benefit and any potential limitations or restrictions on the payment of the benefit. It’s important to carefully review this information and understand the potential tax implications of the death benefit before electing a payment option.

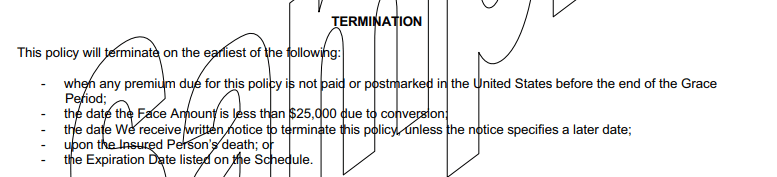

The termination section of a life insurance policy specifies the circumstances under which the policy may be terminated. This may include the policyholder’s death, the policyholder’s failure to make the required premium payments, or the policy reaching the end of the policy term.

Example of the termination section included in a life insurance policy

If the policy is terminated, the insurer may be required to refund a portion of the premiums paid, depending on the specific terms of the policy.

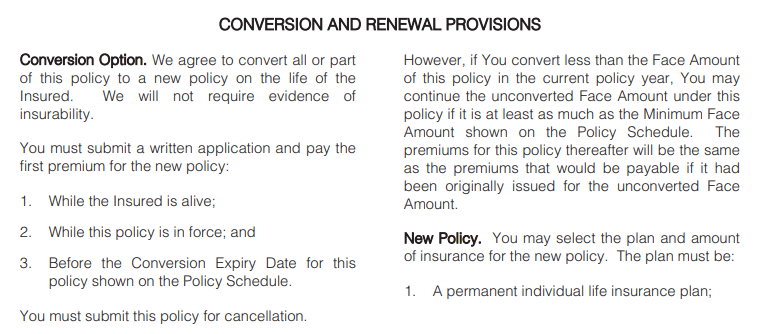

A re-entry option, also known as a conversion option, is a feature of some life insurance policies that allows the policyholder to convert their life insurance policy into a permanent life insurance policy without undergoing a medical exam. This option is typically available during certain periods of the policy, such as during the policy’s conversion period or upon the policyholder reaching a certain age.

Example of a conversion option included in a life insurance policy

The purpose of a re-entry option is to give the policyholder the flexibility to change the type of insurance they have without having to go through the process of applying for a new policy and undergoing a medical exam. This can be useful if the policyholder’s health has changed since they originally purchased the policy, or if they want to increase their coverage without going through the hassle of applying for a new policy.

The change of ownership section of a life insurance policy outlines the process for transferring ownership of the policy from the current policyholder to another person or entity. This section typically includes several subsections that outline the specific steps and requirements for transferring ownership of the policy.

Some common subsections of the change of ownership section include:

Be sure to review the change of ownership section of your life insurance policy and understand the process and requirements for transferring ownership of the policy.

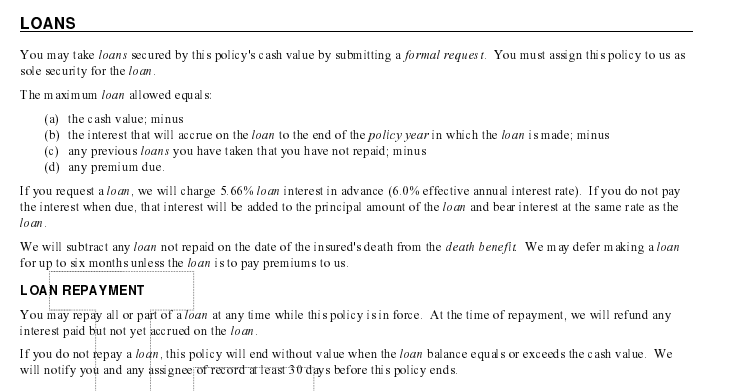

Life insurance policies may offer the option to take out a loan against the policy’s cash value. This option is available with certain types of life insurance policies, such as permanent life insurance policies, which have a savings component that accumulates cash value over time. The cash value of a life insurance policy can be used as collateral for a loan, which can be used for any purpose, such as paying for a major expense, funding a business, or covering emergency costs.

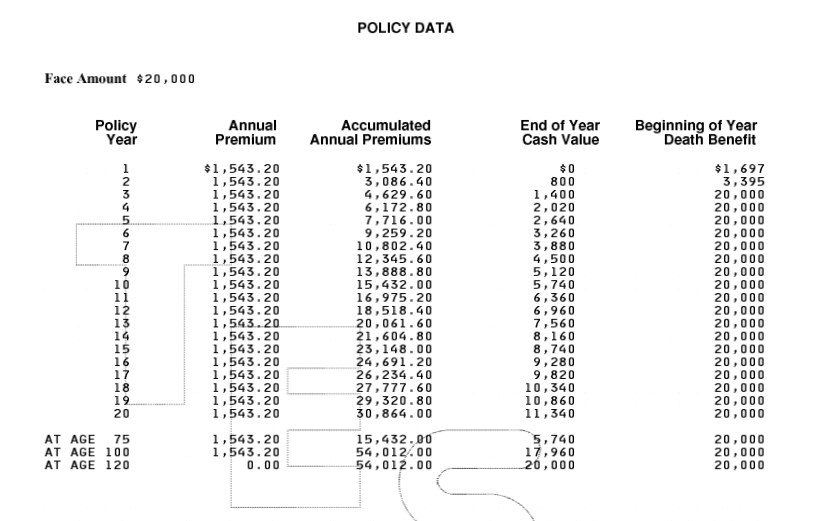

Example of the cash value of a life insurance policy

There are a few different types of loans that may be available through a life insurance policy:

It is important to note that taking out a loan against a life insurance policy can have consequences, such as reducing the policy’s cash value and death benefit, and potentially jeopardizing the policy’s tax-advantaged status. Therefore, it is important to carefully consider the potential risks and benefits before taking out a loan against a life insurance policy.

Should you decide to take out a loan against your life insurance policy for any reason, the interest rate of the loan will be 5.66%. If you do not pay the interest when due, that interest will be added to the principal amount of the loan and bear interest at the same rate as the loan.

Example of loan information included in a life insurance policy

When you take out a loan on a life insurance policy, you are borrowing money against the policy’s cash value. The loan must be repaid, along with any interest that has accrued, according to the terms of the loan agreement.

Repayment of a life insurance policy loan can typically be made in one of two ways:

You can make payments directly to the lender on a regular basis, such as monthly or quarterly, until the loan is paid off.

You can choose to have the loan repaid when the policy is terminated or when the insured person dies. In this case, the loan balance will be deducted from the policy’s death benefit and the remaining balance will be paid to the beneficiary.

It is important to understand that if you do not repay the loan as agreed, the policy’s cash value may be reduced, which could affect the policy’s death benefit. Additionally, if you take out a loan on a life insurance policy and then later cancel the policy or allow it to lapse, any outstanding loan balance may be deducted from the policy’s death benefit, reducing the amount of money that is paid to the beneficiary.

The next section of a life insurance policy is its general provisions including settlements, exclusions, riders, contestability, rights and responsibilities and more (depending on the insurer).

The settlements section explains how your beneficiaries can claim the death benefit after you die. In most cases, it explains how to notify the company of your death and provide a certified copy of the death certificate. Depending on the contract, this section might also explain the options for extending or transferring the benefits of your life insurance policy. This part of the policy will be especially helpful to your beneficiaries if you make them aware of your decision to purchase life insurance. When the time comes to file a death claim, they’ll need to follow the instructions in this section to be able to quickly and accurately receive their benefits.

Exclusions are the situations where the life insurance company won’t pay a death benefit to your beneficiaries. Most policies state that your beneficiaries can’t claim the policy benefit if certain parameters outlined in the clauses in this section are metː

If you added riders to your life insurance policy, this section lays out the terms and conditions for each one. Riders are extra provisions attached to your life insurance policy that may provide extra coverage for you, a loved one, or in the event of disability. Common examples of life insurance riders include terminal illness, long-term care, waiver of premium, accelerated death benefit, and guaranteed insurability options. This section of your policy explains:

Contestability refers to situations in which the life insurance company can contest whether the policy is valid. If your policy has an incontestability clause, the contract will state that the company has a certain period of time (usually 2 years) to review the application for errors and challenge the policy. If you don’t see that clause, the insurer can contest the policy at any time.

Most contracts contain one or more sections that explain your rights under the contract. Read it to find out the terms for:

You should read your policy immediately after signing during your state’s free look period — that way, if you find a mistake, you can cancel the contract without paying a penalty. It’s also a good idea to review it annually to ensure the coverage is adequate for your changing life circumstances.