Life Insurance Waiting Period

Table of Contents

A waiting period in final expense life insurance refers to a specified time frame that must pass after purchasing a policy before the beneficiaries can receive the full death benefit. This waiting period is also known as a “deferral period” or “elimination period”. It is typically applied to individuals with pre-existing medical conditions or those who are considered high-risk.

Two types of waiting periods are commonly used in final expense life insurance policies: graded and modified.

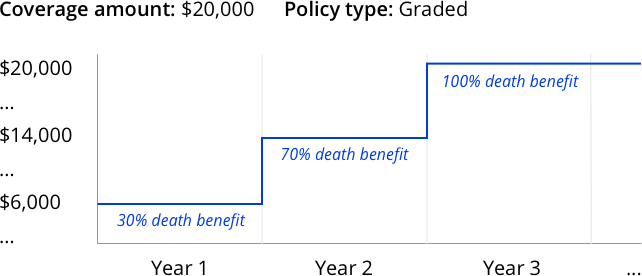

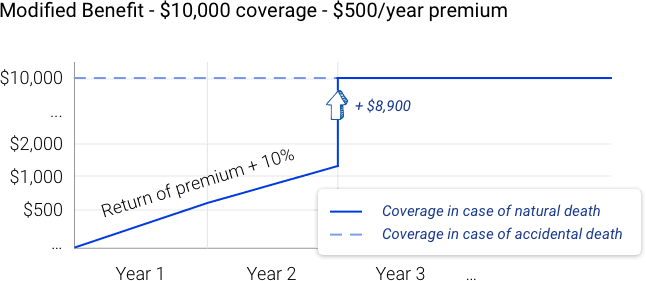

Graded waiting periods typically start with a lower death benefit that gradually increases over time until the waiting period ends. Modified waiting periods have a set timeframe, after which the full death benefit is paid out.

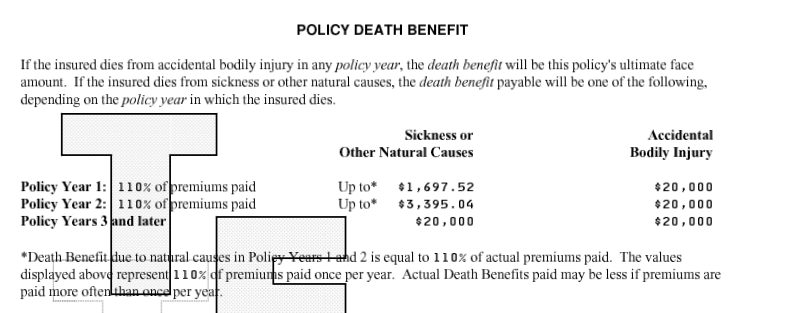

It’s important to note that if the policyholder passes away due to an accident during the waiting period, the policy will pay the beneficiaries the full death benefit.

When considering a final expense life insurance policy, it’s crucial to carefully review the policy documents to understand any waiting periods, exclusions, or limitations that may apply. This ensures that the policy meets the individual’s specific needs and provides adequate coverage for their loved ones in the event of their passing.

An example of a graded death benefit final expense policy could be a policy with a two-year graded waiting period. During this two-year period, the policyholder pays premiums as agreed upon, but if they pass away during the waiting period, the death benefit paid out to their beneficiaries is typically limited to a percentage of the total death benefit.

For instance, the policy may state that if the policyholder passes away during the first year of the waiting period, the beneficiaries will receive 30% of the death benefit. If the policyholder passes away during the second year of the waiting period, the beneficiaries will receive 70% of the death benefit. After the two-year waiting period ends, the beneficiaries would receive the full death benefit amount.

This graded approach is intended to mitigate the risk for the insurance company by reducing their exposure during the first two years of the policy when the risk of the policyholder’s death may be higher. It also allows individuals who may not be able to qualify for a traditional life insurance policy due to health issues to still obtain some level of coverage.

An example of a modified death benefit final expense policy is a policy with a two-year waiting period, after which the full death benefit is paid out if the policyholder passes away due to natural causes. However, if the policyholder dies during the waiting period, the beneficiaries would receive a refund of the premiums paid plus a percentage of interest, but not the full death benefit.

For instance, suppose the policyholder paid $100 in monthly premiums for two years before passing away during the waiting period. In that case, the beneficiaries would receive a refund of $2,400 ($100 x 24 months) plus a percentage of interest, which is typically specified in the policy documents.

However, if the policyholder dies due to an accident during the waiting period, the policy would pay the beneficiaries the full death benefit.

The modified approach aims to provide coverage during the waiting period while protecting the insurance company from high-risk policyholders. It can be an option for individuals who may not qualify for a traditional life insurance policy due to health issues or other factors.

You can find the terms of the waiting period in your life insurance policy document by carefully reviewing the policy contract or policy summary provided by your insurance company. Look for sections that outline the waiting period or deferral period and any limitations or exclusions that may apply.

Example of a graded death benefit section included in a life insurance policy

In most cases, it’s not possible to avoid a waiting period in a life insurance policy. Waiting periods are commonly used in final expense and guaranteed issue policies with no health questions to mitigate risk for the insurance company, especially for high-risk policyholders or those with pre-existing medical conditions.

However, one way to potentially avoid a waiting period is by obtaining a life insurance policy while you are in good health and before any health issues arise. This may allow you to qualify for a traditional life insurance policy that does not have a waiting period or has a shorter waiting period.

As always, it’s essential to carefully review the policy documents and consult with a licensed independent life insurance agent to determine the appropriate insurance policy for your needs.