Why Women Need Life Insurance - Statistics

Reviewed by

Grant Desselle

Licensed Insurance Agent

Reviewed by

Grant Desselle

Licensed Insurance Agent

Throughout the years, a woman’s role in the family and in the business world has changed quite a bit. And with this change has come to her need for life insurance. Whether she’s the primary breadwinner of her family as an executive in the corporate world, a single parent working a 9-to-5, a stay-at-home mom, or something in between, women need life insurance more than ever before.

Many women today are making more money than their spouses or they are working as a single parents and the head of a household. Even a stay-at-home mom has a dollar value attached to her work in the home. This creates a financial responsibility to her family and a need for protection from the loss of her salary should the worst happen.

Table of Contents

The majority of active life insurance policies have males as the insured person. According to the Life Insurance and Market Research Association’s (LIMRA) 2020 study, 58% of life insurance policies in the United States are on the lives of men, while only 47% have a female as the insured.

This does not mean the men are buying more life insurance policies. According to our own 2021 Insurancy Life Insurance Study, while close to 60% of life insurance policies are on the lives of males, women are listed as the owner of 50% of active policies. This means that women are either buying life insurance on males, or women are being listed as the owner of the policy for other reasons.

Some reasons why women may own life insurance policies on men include:

The above possible reasons are from our internal database of over 10,000 sold life insurance policies through our agency over the past decade.

According to Pew Research Center analysis of U.S. Census Bureau data. 28% of mothers do not work outside the home. These stay-at-home mothers work reduced hours in order to accommodate family needs. While they may not be paid for their work, the value of their labor is immense. Salary.com that stay-at-home moms work 106 hours per week on average, which means they are working 15 hours a day, 7 days a week for a time value of money of $184,820.

By our own calculations, when considering the lowest pay possible, we still get a staggering salary.

If you find out you have the BRCA gene from Ancestry DNA or 23 and Me, seek out a life insurance policy right away.

A breast cancer diagnosis renders women uninsurable for life insurance. In order to be considered for life insurance again, women must be in remission for at least 3 years.

Fertility treatments include an array of medications that result in a woman becoming uninsurable. If you have a treatment scheduled, are currently undergoing treatment, or have recently had treatment, insurance companies will not issue life insurance.

Even if you have a child, it is smart to buy more life insurance if you plan on having more children.

According to the United States Department of Labor, 57 percent of women participate in the labor force. And the Bureau of Labor Statistics reports that women make up about 47 percent of that workforce. Despite these facts, women are consistently under-covered when it comes to life insurance. According to the Insurance Information Institute, 43 percent of adult women have no life insurance. And among those who are insured, they only carry about a quarter of the coverage necessary for their needs.

On average, women have $129,800 of individual life insurance, compared to $187,100 for men. Additionally, women with high personal incomes of $100,000 or more are less likely to have life insurance than men at the same income level. Take advantage of group life insurance offered through work.

If your income helps to support you, your children, and/or your partner, a life insurance policy will provide financial support to them in the case of your death. This can help with the everyday expenses, of course, but it can also assist with helping to cover the cost of the funeral and anything related to it. Sure, it’s unpleasant to think about and plan for your own death, but it is a responsible way to make sure your family doesn’t have to worry about such things on top of having to deal with your loss.

If you’re single and you don’t have any children, ask yourself a couple of questions concerning your life insurance needs:

Typically, the executor of your estate will sell off whatever they can to help pay off your debts when you die. If you have co-signer on a loan, however, they will be responsible for repaying it. Of course, if neither of these scenarios applies to you, you’re probably OK to put off purchasing a life insurance policy. But keep in mind, it’s cheaper to buy one when you’re younger.

As a general rule of thumb, and depending on your age, you should multiply your income by anywhere from three to 15 times to arrive at the amount of life insurance you should consider buying. So, if you’re a 40-year-old woman making $50,000 per year at your job, you will want to look at buying a policy that’s worth about $750,000.

See our simple life insurance calculator and determine your need.

And as a stay-at-home mom, don’t sell yourself short when deciding on an amount for life insurance. Just because your family doesn’t depend on your income, it doesn’t mean you don’t need any life insurance. Life insurance companies provide spouses the same amount in coverage.

According to Loretta Worters, vice president with the Insurance Information Institute, if a stay-at-home spouse dies, the family would need someone to handle the household duties. That’s no small task. The cost could be substantial and a life insurance policy would help to cover those expenses.

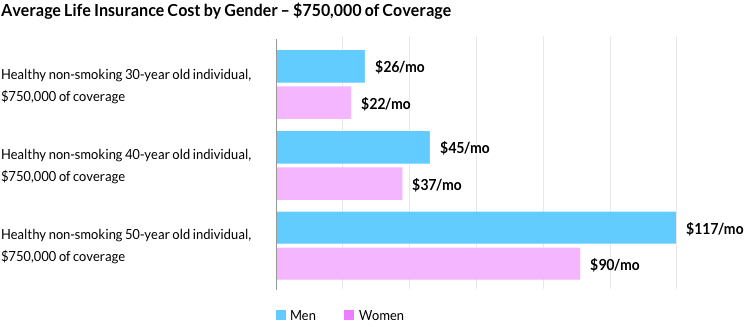

There is a difference between what men and women pay, primarily because men have a shorter life expectancy than women. In fact, women outlive men by about five years. Women tend to develop cardiovascular problems like a heart attack or stroke later in life than men do. This longer life expectancy will help to lower your life insurance premiums.

When it comes to the different types of life insurance you can choose from, it’s the same as men. You can select a level-term life insurance policy at a cheaper premium for a specific amount of time, or you can select a whole life insurance plan that will last the rest of your life and provide you with additional financial planning options. Maybe a no medical exam life insurance policy is the way to go for you. The type of insurance you choose and the amount you purchase depends on your goals, needs, budget, and family situation are.

For instance, if you are still young and single, your life insurance needs will be much different than if you are a bit older, married, and/or raising a family.

No matter what your current life situation, a licensed independent life insurance agent is ready to speak with you about your life insurance needs. Insurancy compares the policies and rates of hundreds of different insurance companies to find your best solution. Speak with a licensed agent today at 1-866-816-2100.