Underwriting Your Life Insurance Application

Reviewed by

Grant Desselle

Licensed Insurance Agent

Table of Contents

What is Underwriting?

First of all, let’s take a look at underwriting. It can be a bewildering term to many life insurance applicants.

Underwriting is a term that is used by insurance companies to describe the insurance company’s process for reviewing, modifying and then approving or declining life insurance applications. It’s a necessary part of applying for life insurance. Underwriting ensures that individuals are properly classified in the appropriate risk class and it also protects the insurance company from fraud and those applicants that misrepresent themselves.

Think of it as a risk management. The process consists of evaluating information from a variety of resources to determine how an individual will be classified. One of three things is going to happen when you apply for life insurance. Your application will be approved, you will be asked to agree to some modifications, or it will be declined.

If you’re approved, great. Now, if you are asked to make some modifications to your application, that’s good, too. It could be to change the total amount of coverage, the premium rate class, or to change some of the benefits due to a medical condition or a risky hobby, like skydiving. If you’re declined, it’s because your medical condition, based on your health history and all of the information gathered by the underwriter, falls outside the range of insurability that was established on your application. It could also mean that the amount of coverage you requested is greater than your financial need.

If you work with Insuirst, you won’t be turned down because we will make sure you don’t submit an application that will be declined. That’s the relationship we have with you as a valued customer. Just call 1-866-816-2100 and a licensed agent will be pleased to speak with you about your insurance needs—and answer any questions you may have, accurately and honestly.

You see, underwriting life insurance is all about risk management — the process of classifying, rating, and selecting risks. The underwriter’s job is to use all the information gathered from numerous sources to determine whether or not to accept a particular applicant. You are then rated, typically according to the following categories:

- Preferred — low risk, not sick, don’t have a high-risk job or hobby, clean bill of health, lower premium.

- Standard — average risk, some health issues in the past, but not a terminal illness or a high-risk job or hobby, average premium

- Substandard — high-risk job or a chronic illness, higher premium

- Uninsurable — extremely high risk, terminal illness

The underwriter must employ sound judgment based on his or her years of experience to read beyond the basic facts and get a true picture of the applicant’s lifestyle. For instance, the underwriter will look for any factors (such as occupation, dangerous hobbies, etc.) that could make the applicant more likely to die before his or her natural life expectancy, or reasons to anticipate that the individual may become ill or involved in an accident that will create high medical expenses. Of course, the underwriter certainly cannot—and isn’t expected to—foresee all possible circumstances. The underwriter’s primary function is to protect the insurance company insofar as is possible against adverse selection (very poor risks) and those parties who may have fraudulent intent.

As promised, here are some of the primary resources an underwriter uses to assess your level of risk.

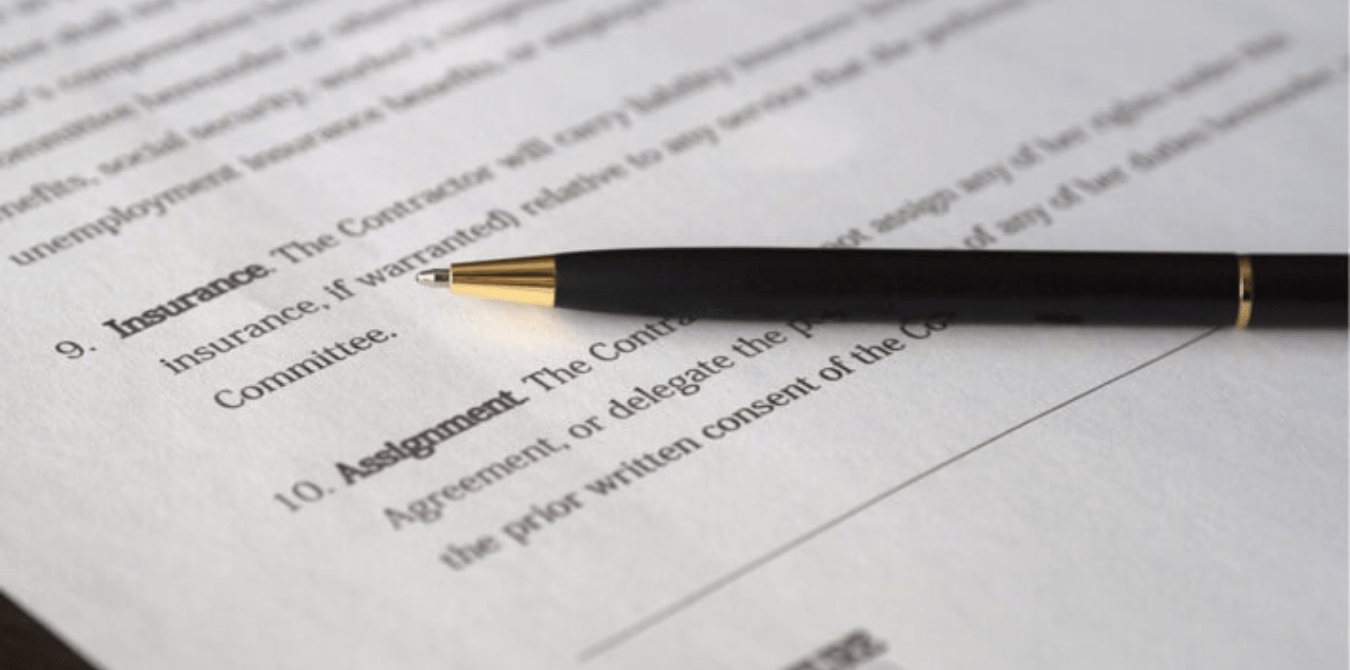

Application

This one’s a no-brainer, right? Without the initial application, there won’t be any policy issued. The typical life insurance application is divided into sections, with each section designed to obtain specific types of information. The style of the application may differ from one insurance company to the next, but it’s usually asking for personal and medical information. Remember, when it comes to life insurance, honesty is always the best policy. It never pays to be deceitful on an application.

Medical Examination

Depending on your age and the amount of insurance you apply for, a medical exam might be necessary. Medical exams and tests, when required by the insurance company, are conducted by physicians or paramedics at the expense of the insurer. They will typically check your pulse and blood pressure and then collect urine and blood samples to check for the presence of drugs and/or nicotine plus your cholesterol, glucose, red and white blood cell counts, etc. The exact process, again, will depend on your age, past health history, family history and the amount of insurance you’re applying for.

Medical Information Bureau Report

MIB, or MIB Group, Inc., is a membership corporation owned by roughly 500 member insurance companies throughout the United States and Canada. Previously known as the Medical Information Bureau, the organization was created in 1902 to provide fraud protection services to insurance companies.

MIB maintains a confidential consumer database that is accessible only by its member companies. It exchanges personal data about individuals among its members and also issues consumer reports to them. In turn, MIB also provides full disclosure to consumers regarding their files.

An MIB insurance report can include your previous or existing medical conditions, prescription medication history, as well as other issues like hazardous hobbies, adverse driving records—anything that could have an impact on your ability to be insured.

These reports alert insurance providers to potential errors, omissions, and/or misrepresentations that may have been made during the application process.

If the reports are inconsistent with the information you provided, insurance companies are then required to conduct an investigation to obtain more information about your reported medical histories and/or conditions before making a decision to either accept or deny your insurance application.

Driving Record

Didn’t see this one coming? It’s true, your driving record has an impact when it comes to life insurance. In fact, a single traffic ticket could substantially raise your premium and a history of poor driving or traffic violations could mean you will be denied coverage altogether.

Depending on the circumstances of each ticket, one violation could raise a red flag. Underwriters are prompted to check driving records for one simple reason: the roadways are deadly. According to the Annual Global Road Crash Statistics, over 37,000 people die in road crashes each year in the United States. So even if your driving history isn’t requested on the life insurance application, the underwriter is looking at your record. Some insurers don’t include driving-related questions because they pull information directly from the Department of Motor Vehicles, so it’s best to be honest up front.

Other Reports

Additionally, the underwriter might order a report from an independent investigating firm or credit agency, which would provide financial and/or lifestyle information. What you do for a living matters. If you sit at a desk all day, you’re not posing as much of a risk as someone who cuts down large trees every day. What you do for fun also matters. Do you have any risky hobbies? If you like to jump out of airplanes with a parachute on your back every weekend, you are a higher-risk applicant than someone who doesn’t involve themselves in that kind of activity.

Your Life Insurance Policy Application

Your relationship with your life insurance agent is a key part of the application process. That’s where we come in. A licensed True Blue Life Insurance agent is going to talk with you and help you accurately answer the questions on the application—plus answer any questions you have about the process before anything gets to the insurance company’s underwriter. Just pick up the phone and call 1-866-816-2100.

As an independent insurance agency, Insurancy deals with all of the top insurance companies on your behalf, so we will work to get the best price for you and address any concerns you may have.

See what you qualify for by answering some health questions.