TruStage Life Insurance Review

Reviewed by

Grant Desselle

Licensed Insurance Agent

Reviewed by

Grant Desselle

Licensed Insurance Agent

Table of Contents

TruStage Life Insurance Agency operates as a subsidiary of CMFG life, who underwrites its policies by partnering with other insurance companies. Historically, its products have been marketed through credit unions, which is how the company was initially formed in 1935. While this tradition continues to the present, its products are available to anyone.

Their guaranteed-acceptance plans may appeal to those struggling to receive acceptance from other life insurance providers.

This, of course, is their ideal niche. Since this is not the most affordable life insurance out there, TruStage appeals to customers who need life insurance with few questions asked. Healthy applicants may find better options elsewhere, but if you’re older or have some disqualifying health conditions, TruStage can be a welcome—albeit last resort—option to provide coverage for you and your beneficiaries.

| Customer Service Phone | 1-866-317-1138 |

| Agency Website | www.trustage.com |

| Parent Company Website | www.cunamutual.com |

| Address | Cuna Mutual Group 5910 Mineral Point Road Madison WI 53705 |

| BBB Rating | B+ (view) |

TruStage offers guaranteed acceptance policies, which means that customers can always rely on these policies if they have been denied coverage elsewhere.

None of TruStage’s policies require a medical exam for approval, though there may be some medical questions involved to set the premium.

TruStage offers an easy-to-use, mobile-friendly website with a calculator for obtaining online quotes for some of its policies.

The whole life product is well-priced, goes up to $100,000 in coverage, and has a simple online application process.

If you want a policy today, TruStage is an easy option.

TruStage offers low coverage amounts, with their term policy capped at $300,000.

No riders are available to customize their policies.

Their term product is best for those in average to below-average health. There are few health questions and approvals are provided instantly.

TruStage takes a different approach to its term life insurance policies. With most companies, you choose your term length, usually a 10, 20, or 30-year policy. With TruStage, you don’t select a term. Instead, your policy expires once you turn 80.

Additionally, your premiums will increase once you reach the 5-year age brackets: 25, 30, 35, 40, 45, 50, 55, 60, 65, 70 and 75. To clarify, these increases coincide with the age of the policyholder, not the age of the policy. This might be a turn-off to those expecting level premiums for a longer period than five years.

As with TruStage’s other policies, there are no medical exams.

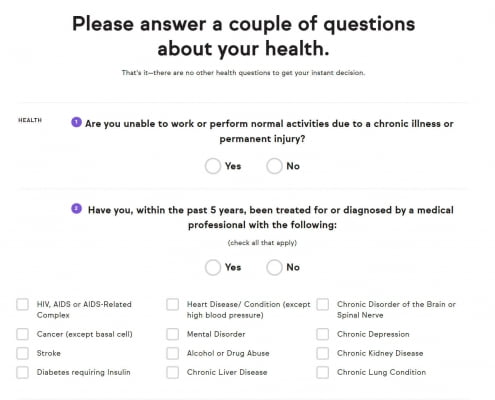

The application has just 2 health questions.

The tradeoff for paying more in premiums that increase every 5 years, is that there are few requirements for approval.

TruStage allows you to convert all or part of your coverage to whole life at any time after the policy is in force. No health questions asked.

TruStage’s term life policies are capped at a max of $300,000. This is actually reasonably competitive for a simple-issue policy, but applicants seeking greater coverage might find better values through traditional underwriting at another company.

While the policy is easy to qualify for, you pay considerably more in premiums.

This is not a guaranteed-level policy. The coverage amount stays the same, though the premiums increase every 5 years.

TruStage’s whole life insurance offers permanent, lifelong protection, with a benefit and premium that remains locked in from the date of issue.

No medical exam is required, though you will have to answer some medical questions prior to approval.

This whole life product offers limited coverage, ranging from $1,000 to $100,000. This may make it ideal for a form of final expense insurance, though customers looking for a larger death benefit may wish to look elsewhere.

TruStage offers guaranteed whole life insurance for applicants 45 and older. These policies offer limited coverage (a maximum of $25,000), but rates stay locked in for life and they cannot be turned down due to their health.

The application takes minutes to complete.

Pricing may be higher than competitors. The policy may have a waiting period.

A healthy, 30-year-old male looking for term life coverage can expect to pay over $40.00 a month through TruStage. And without level premiums, these rates will increase every 5 years and can rise dramatically with age.

Even for simple-issue insurance, TruStage is costly. These plans will only appeal to those who struggle to meet the approval standards of other companies, making TruStage a bit of a costly last resort.

TruStage only offers coverage up to $300,000. Additionally, they provide no riders with which to customize your insurance plan. Many customers may wish to look elsewhere for policies with greater benefits and customizable features.

| 35 Year Old Male | $46.50 Monthly | $100,000 Term Policy |

| 35 Year Old Male | $48.00 Monthly | $40,000 Whole Life Policy |

| 55 Year Old Male | $170.50 Monthly | $100,000 Term Policy |

| 55 Year Old Male | $128.00 Monthly | $40,000 Whole Life Policy |

Check prices with TruStage competitors/alternatives use our comparison engine

TruStage (CMFG Life Insurance Company) has been given favorable ratings from the following agencies:

This means that customers can have confidence that the company will follow through with its promises and benefits.

| Total Annual Insurance Premiums | $1,300,488,500 |

| Annual Individual Life Insurance Premiums | $546,296,988 |

| Annual Revenue | $4.12 Billion |

| Fortune 1000 Revenue Rank | #615 |

The majority of complaints filed against insurance companies are done through the customer’s state department of insurance.

The National Association of Insurance Commissioners performs periodic reviews of the complaints received by all the state departments of insurance. A score of 1.0 indicates an average number of customer complaints. This means a company with a complaint index of 2.0 has a complaint index that is twice as high as expected in the market. A company with a complaint index below 1.0 has fewer complaints than the average.

| Total Complaints Filed with State Insurance Departments | 13 |

| NAIC Company Complaint Index Score | 0.49 |

| National Index Complaint Color | Green = 51% less complaints than average |

| Better Business Bureau | TruStage BBB Complaints Page |

TruStage has fewer complaints than most insurance companies, which is a good sign for potential and current policyholders.

TruStage has reviews at the following third parties.

TruStage Life Insurance Agency has amazing reviews from its customers. This is a credit to the simple online application and access to your policy in the online portal. Customers find it easy to make payments and manage their policies.

The negative reviews are primarily regarding TruStage sending an inordinate amount of sales emails. Some customers reference the prices were higher than quoted, which is not unusual because there are health questions.

The TruStage term product rates increase every 5 years. If you are looking for term life insurance, first look at guaranteed-level term products that have 10, 15, 20, or 30-year terms.

The TruStage whole life product is competitive with a simple online application. Depending on how you answer the application questions determines if the death benefit has a waiting period. We like that there is a guaranteed acceptance.

Definitely compare pricing with other companies on our comparison engine.