Join a Group That Offers Life Insurance

Reviewed by

Lisa A Koosis

Medical Claims Specialist

Reviewed by

Lisa A Koosis

Medical Claims Specialist

Table of Contents

Joining an association that offers life insurance to its members can provide an affordable and convenient solution for individuals who do not have access to employer-provided group life insurance or want to supplement their existing coverage.

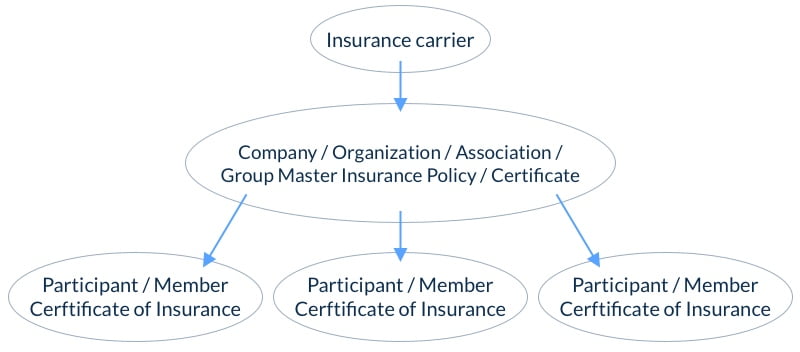

Group life insurance is a type of life insurance coverage in which a group is the master policyholder of an insurance contract, and certificates of insurance are issued to participating individual members.

These insurance policies are most commonly offered by employers to their employees as a free or optional benefit. Entities such as organizations, trade groups, and associations also can offer group life insurance to their members.

It is available to people of all ages, and there are few health questions, if any, that must be answered in order to qualify. Term and whole life policies may be available, depending on the group.

When group life coverage is offered as a free benefit – in this case, there is no reason to pass it up.

Group life insurance is a benefit and should not be the only life insurance coverage you have. It is recommended that you have individual life insurance, and a group life policy as additional coverage.

Since the risk of a claim is spread out among a large group, coverage costs are low for participants. Optional group coverage may or may not be a good financial decision. For those in good health, it is often cheaper to purchase an individual life insurance policy than to spend money on group coverage.

If you under 50 years of age and cannot qualify for individual life insurance, group coverage may be the only way to obtain life insurance.

Since there are few health questions that must be answered to qualify for group life coverage, this type of insurance is an option for people with health conditions such as:

There are many types of groups and they all have different requirements for becoming a member.

Some charge membership fees or have participation requirements for its members.

Another way to find potential groups/associations is a google search for membership life insurance benefit

Access to groups and associations is a way to get access to insurance products and rates that are not possible for individuals.

The risk to the insurance company is spread out among many participants in group plans. Group life insurance is often free for qualifying employees and group members.

Group life plans have few health questions to qualify. Some plans have no health questions. The more coverage you apply for, the more health questions.

Applications are one or two pages, and they are active when the policy is processed by the insurance company. How fast this happens depends on the group and insurance company issuing the certificates. If you apply online, your policy may be active the moment you sign and date the application.

group policies do not have waiting periods for the full coverage amount to be available to beneficiaries. Some final expense whole life policies have a two-year waiting period for the full coverage amount is available.

Medical exams cost insurance companies money. For small group life plans, the risk to insurance companies is small, so exams are not required. Typically the application is the only requirement to qualify.

When coverage amounts are small, insurance companies do not run financial risk assessments. Risk assessments cost the insurance company money are not required. As you increase your coverage amount, the insurance company may require this qualification requirement.

Individual life insurance policies use build charts as one of the factors in determining the cost of a policy. Group life plans don’t have health classes so there is no need for height and weight requirements.

As with group life insurance offered through an employer, the association is the ultimate policyholder. The association holds the master policy, and issues certificates of insurance to its members. While a certificate of insurance is valid proof of having a life insurance policy, you are not the owner of the policy.

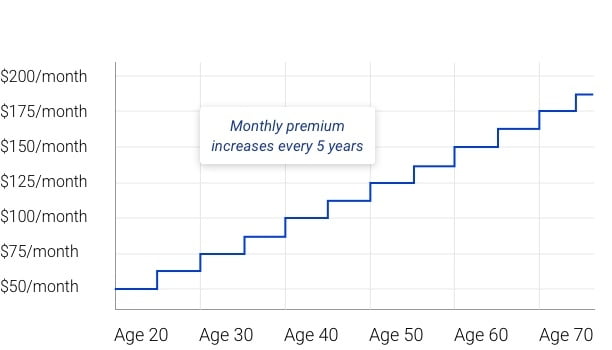

If the premiums aren’t guaranteed and the group experiences too many claims they can raise the premiums. Another way the premium could increase is if the plan offered is a “banded term policy in which the premiums increase every five years.

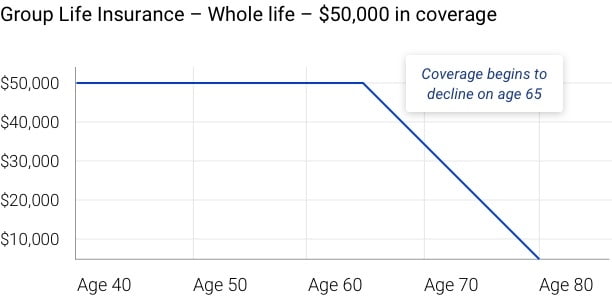

This happens when the premiums are guaranteed, but the coverage isn’t. As you age, the risk to the insurance company increases. When you reach a certain age, typically 60 years old, the coverage amount begins to decrease every year.

Group life is easier to qualify for than fully underwritten individual policies. Since there are so few health questions, the insurance company lowers its risk by offering low amounts of coverage.

The insurance company does not handle general services like updating billing or beneficiary changes. Instead, service is often handled by the master certificate holder. This can cause confusion when the plan administrator is not a licensed insurance agent.

Group term policies with 5 year coverage periods. Every five years the cost of the coverage increases.

Group whole life policies with guaranteed level premiums where the coverage amount decreases after age 65.

Depending on your personal situation, the pros can far outweigh the cons. Especially for individuals who would have a tough time qualifying for an individual life insurance policy, due to their health. Yet, group life insurance popularity has been declining for the last decade. Why?

This could be largely due to the fact that fewer employers are offering group life insurance through work. Many individuals aren’t aware that they can join a group or association that offers this type of insurance on their own.

Of individuals who have life insurance in general, 55% of people have an individually owned life insurance policy, which is still the most popular choice by far. One in four individuals (27%) have group life insurance only.

Lastly, 18% of people who have life insurance, have both an individual and group owned policy.

Group life insurance is a type of life insurance coverage that is provided to a group of individuals, u

sually through an employer or membership organization. It differs from individual life insurance in that the policy is owned by the group or organization rather than the individual and typically provides lower coverage amounts at a lower cost per person.

Example: The American Association of Retired Persons (AARP) offers group life insurance to its members, with coverage amounts ranging from $10,000 to $100,000.

Many different types of groups offer life insurance to their members, including professional associations, trade unions, fraternal organizations, and alumni associations. To choose the best group for you, consider the cost of membership, the level of coverage offered, and any additional benefits or perks provided by the group.

Example: The Freelancers Union offers life insurance to its members, as well as access to discounted dental and vision care, tax services, and legal advice.

Each group may have its own age limits for joining and participating in its life insurance program. Some groups may have a minimum age requirement of 18 or 21, while others may not have a maximum age limit.

Example: The National Association of Realtors offers group life insurance to its members with no maximum age limit, as long as the member is actively licensed and engaged in real estate activities.

The enrollment process may vary depending on the group or organization. Typically, you will need to complete an application and provide personal and demographic information, as well as pay any membership or signup fees required by the group.

Example: To join the Freelancers Union and enroll in its life insurance program, you would need to complete an online application, provide proof of freelance income, and pay a one-time $175 membership fee.

The amount of life insurance coverage and cost of premiums will vary depending on the group and the individual policy. Some groups may offer a set amount of coverage for all members, while others may allow you to customize your coverage amount and premiums based on your individual needs and budget.

Example: The National Association of Social Workers offers group life insurance to its members with coverage amounts ranging from $10,000 to $1 million, with premiums based on age, gender, and smoking status.

Medical exams and health screenings may be required by some groups, particularly if you are applying for a higher level of coverage or if you have a pre-existing medical condition. However, many groups offer guaranteed issue coverage, which means you can qualify for coverage without any medical underwriting.

Example: The American Legion offers guaranteed issue group life insurance to its members with coverage amounts ranging from $1,000 to $5,000.

The approval process may vary depending on the group and the individual policy. Some groups may offer instant approval, while others may take several weeks to review your application and underwrite your policy.

Example: The National Association of Professional Women offers group life insurance to its members with instant approval and coverage starting as soon as the first premium payment is received.

Some groups may offer the ability to customize your coverage amount, premiums, and additional benefits based on your individual needs and budget. However, not all groups may offer this level of customization.

Example: The National Association of Home Builders offers group life insurance to its members with the ability to customize coverage amounts and premiums based on age, gender, and smoking status, as well as the option to add coverage for accidental death and dismemberment.

Each group may have its own rules and restrictions regarding changes to coverage amounts, premiums, and additional benefits. Some groups may allow you to make changes at any time, while others may only allow changes during open enrollment periods.

Example: The American Dental Association offers group life insurance to its members with the ability to make changes to coverage amounts and premiums during open enrollment periods, which occur annually.

Many groups offer additional benefits and perks to their members, such as discounted medical services, access to wellness programs, and career development resources. These benefits may differ from individual plans in terms of cost and availability.

Example: The National Education Association offers group life insurance to its members, as well as access to discounted legal services, auto and home insurance, and travel discounts. These benefits are not typically available through individual plans.

Join an association that offers life insurance to members.