Best Indexed Universal Life Companies

Table of Contents

What Is Indexed Universal Life Insurance?

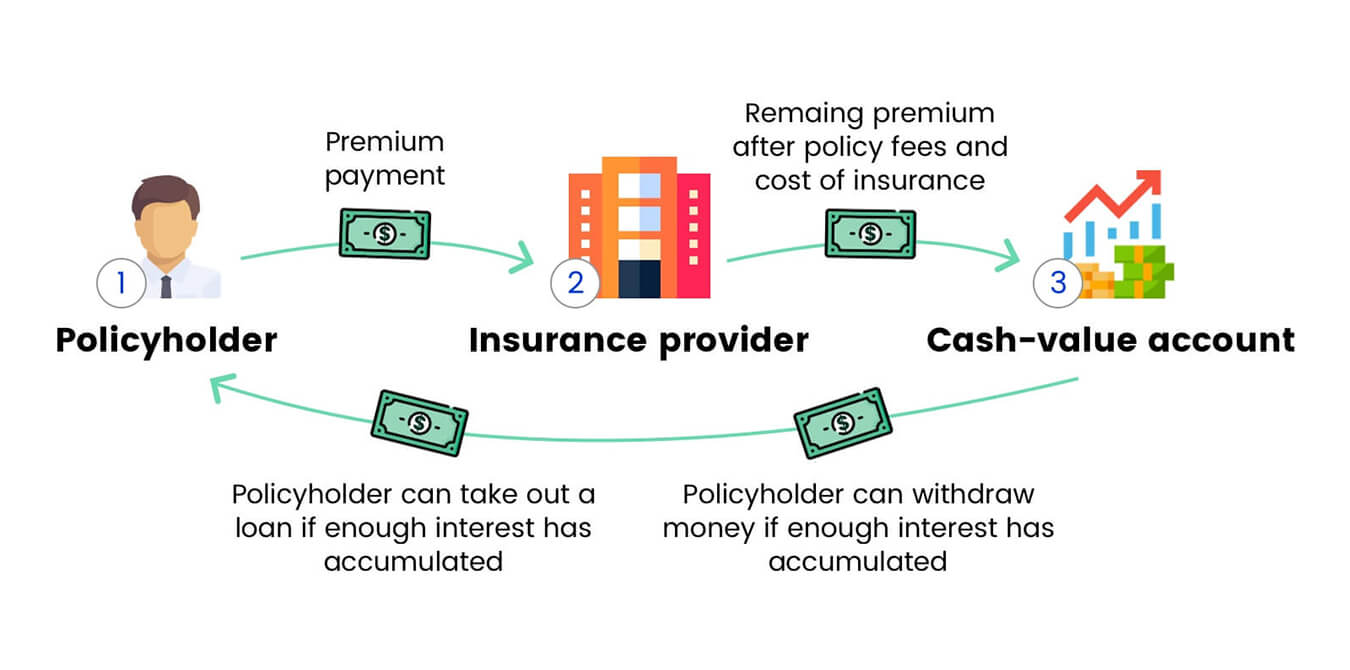

Put succinctly, indexed universal life insurance provides permanent life insurance protection, cash-value accumulation, and growth – via fixed and indexed accounts.

Referred to as an advanced life insurance product, an IUL includes certain steps and attributes.

At a glance

- The policyholder makes a premium payment.

- Policy fees are paid.

- The remaining premium amount is placed in cash-value accounts.

- The life insurance company credits the cash-value accounts with interest.

- Policy loans or withdrawals can be utilized.

- Death benefit is paid to beneficiaries upon the death of the insured.

In-Depth

Let’s evaluate the components of indexed universal life insurance thoroughly.

Premium Payment

Premiums are what you pay in exchange for life insurance coverage.

Generally speaking, your premium payment amount is primarily determined by:

- Type of life insurance

- Face amount

- Age

- Risk evaluation, including health status

- Optional riders

An indexed universal policy’s premiums have key features:

- Flexibility to vary the amount paid

- Option to pay a maximum, within federally established tax limits

- Option to pay a minimum amount to keep the policy in force

- Premium allocation is typically fluid and determined by policyholder

- Eventually, cash-value may cover premium payments

Policy Fees

An IUL includes fees – typically four – to keep the policy up and running.

Before your premiums are placed in cash-value accounts to grow, charges must be covered.

- Premium load charge

- Monthly charge

- Annual fee

- Mortality charge

First, you will pay a premium load charge and monthly charge, typically per $1,000 of death benefit. Think of these fees as transactional charges. Usually, the premium load charge is included with each premium payment, while the monthly charge lasts for the first 10 years of the policy. Next, plan to pay the usually modest annual fee yearly. Finally, the mortality charge covers the death benefit of your policy. This charge almost always increases with age.

Cash-value Accounts

Once all policy fees are covered, the remaining premium is placed in cash-value accounts.

Cash-value accumulation occurs within two sub-accounts:

| Fixed account | Indexed account |

|---|---|

| The fixed account is a cash-value sub-account, in which the life insurance company establishes a fixed percentage rate for interest crediting.

For example, the life insurance company may offer a fixed rate of 2% of guaranteed minimum annual growth on all funds placed into the fixed account. | The indexed account, another cash-value sub-account, is connected to, but not directly invested in, the stock market.

For example, most indexed accounts are linked to the performance of major indices, like the S&P 500 and NASDAQ 100. |

There are three “levers”, so-to-speak, that affect the growth of the indexed account – floor, cap, and participation rates. Think of the “levers” as protective measures put in place for both the policyholder and the carrier. To safeguard your money, a policy floor rate is established.

How? The carrier sets a cutoff point on the minimum amount of money that can be lost, if any, or gained in any given crediting period.

Often, the floor rate is 0%, meaning that no money is lost. Sometimes, the floor rate is a minimum earning of 1-2%, regardless of the performance of the indices.

Further, carriers set a cap rate to limit growth in your cash-value sub-account.

How? If the stock market sees exponential growth, life insurance companies set a limit of say, 10% for example, to establish a threshold of how much is paid during a crediting period.

Lastly, carriers establish a participation rate that determines the percentage of the index growth that is credited to your account.

To understand how the floor, cap, and participation rates affect your policy, think of a simple mathematical equation:

Index Change (subject to floor and cap rates) x Participation Rate = Credited Interest Rate (for each crediting period)

Index crediting periods vary by carrier and product, but are almost always one of the following:

- Daily averaging

- Monthly point-to-point

- Annual point-to-point

| Elements | Example |

|---|---|

| Fixed rate | 2% |

| Index Selection | S&P 500, NASDAQ 100 |

| Index Cap | 10% |

| Index Floor | 0% |

| Index participation rate | 100% |

| Policy loan rate | 3 – 6% |

Policy Loans

If there is enough money within your cash-value accounts, policy loans are available.

An IUL policy typically includes three types of loan options:

- Fixed – the carrier charges a defined interest rate on your loan and earns a rate of return – by placing the same amount of money borrowed by you into a collateral account that invests the funds.

- Indexed – the loaned money continues to be tied to the policy’s indices, and the carrier charges a fixed interest rate – typically higher than a fixed loan.

- Variable – the loaned money also continues to be tied to the policy’s indices, however, the carrier charges a variable interest rate.

Most policy loans are not taxable.

The benefits of a policy loan include:

- Simple borrowing process

- No credit checks

- Finance major purchases

- Repayment schedule on your own terms

- Typically lower interest rate than personal loans

- Option to not repay loan

Important – if you choose to not repay your loan, your death benefit may be reduced.

Policy Withdrawals

Additionally, you have the option to withdraw money from your cash-value accounts.

Especially if your IUL has been in force for many years, policy withdrawals can be used as an excellent source of tax-advantaged retirement income.

Note – just like unpaid policy loans, policy withdrawals usually reduce the death benefit.

Death Benefit

Foundationally, indexed universal life insurance, by its very name is just that – life insurance protection, and not an investment.

An IUL’s death benefit safeguards your beneficiaries through permanent financial protection.

The death benefit of an IUL policy is adjustable so that you can alter the amount – should your financial needs change over time.

Important

It’s worth noting that indexed universal life insurance is one of four forms of universal life insurance.

- Universal life insurance (Traditional)

- Indexed universal life insurance

- Variable universal life insurance

- Guaranteed universal life insurance

Each form of coverage includes its own features:

| Universal | Indexed Universal | Variable Universal | Guaranteed Universal | |

|---|---|---|---|---|

| Risk | Less | Moderate | More | None |

| Premiums | Flexible | Fexible | Flexible | Fixed |

| Permanent | Yes | Yes | Yes | Designed to be |

| Cash value | Yes | Yes | Yes | Fixed |

In addition, it’s constructive to compare and contrast universal policies with other standard forms of life insurance, to confirm you are buying the best type of coverage to meet your needs.

| Term | Whole | Universal | Indexed Universal | Variable Universal | Guaranteed Universal | |

|---|---|---|---|---|---|---|

| Permanent Coverage | No | Yes | Yes | Yes | Yes | Designed to be |

| Cash Value | No | Yes | Yes | Yes | Yes | No |

| Flexible Premiums | No | No | Yes | Designed to be | Yes | No |

| Flexible Death Benefit | No | No | Yes | Yes | Yes | No |

| Investment Option | No | No | No | Yes | Yes | No |

Who Is Indexed Universal Life Good For?

There are ideal candidates for an IUL policy:

- Income replacement should primary wage-earner die

- Retirement income supplementation

- Business owners

- Finance major purchases

- Estate planning

- Generational wealth transfer

Income Replacement

Remember, fundamentally, indexed universal life provides life insurance protection for the insured.

In the event of the insured’s death, the death benefit is often structured to replace income – giving peace of mind to those who depend on the insured financially.

Retirement Income

Traditionally, retirement has been financed through a few main sources:

- Pension or 401k

- Social security

- Savings plans

Over time, indexed universal life insurance policies have become increasingly popular as an additional option for retirement income.

A properly funded IUL supplements retirement through policy loans and withdrawals.

Business Owners

IULs often meet the particular life insurance needs of business owners.

Specifically, indexed universal life insurance can fund:

- Key person insurance

- Buy-sell agreements

- Executive bonus plans

As a business owner, an IUL may be an excellent option to safeguard your business if a key employee dies, a major shift in your business occurs, or to financially reward specific important employees.

Finance Major Purchases

IUL policy loans are often an excellent option to finance major purchases.

Usually, the interest rate on the loan is lower than what you would find with a personal loan, and especially credit cards.

- Home improvement

- College tuition

- Car purchase

- Down payment on a home

- Vacation

Estate Planning

The death benefit of an indexed universal life insurance policy provides liquidity.

In other words, immediate funds are available to the beneficiary to cover estate expenses:

- Taxes

- Purchase assets from estate

- Lend money to estate

Generational Wealth Transfer

A wealth transfer involves strategically passing assets from one generation to the next.

If you have assets you would like to pass on to your children or grandchildren, whether they are modest or significant, an IUL provides a tax-advantaged vehicle for doing so.

Bottom line – For the right applicant, indexed universal life insurance is a sound option.

Who Is Indexed Universal Life Bad For?

Indexed universal life insurance is not for everyone.

We recommend evaluating a different form of coverage under the following circumstances:

- Only interested in death benefit

- Modest budget for life insurance

- Uncomfortable with market fluctuations

- No need for permanent life insurance protection

You Only Need A Death Benefit

For some, the only reason to purchase life insurance is for death benefit protection. You may not have an interest in cash-value accumulation. In that case, term life insurance is likely your best bet. Term coverage provides larger face amounts with modest premiums. Keep in mind, however, term policies only provide temporary life insurance protection – for instance, 20 years of coverage.

Modest Budget

An indexed universal life insurance policy is not for someone with a modest life insurance budget. Because an IUL policy features permanent protection and cash-value accumulation, plan to pay substantially more.

For instance, the cost is 6 – 10 times more for a permanent product with cash value, like an IUL, than for a term policy. Additionally, as you age, the mortality cost of your policy almost always increases, making the policy fees more expensive.

Market Fluctuations

IUL policy illustrations, at the end of the day, are merely projections.

In reality, the performance of your indexed cash-value account is dependent on the performance of the market.

While the projections are based on sound historical data, past performance does not guarantee future results. You will need to be comfortable with policy illustration ambiguity.

Note – in an attempt to simmer down indexed universal illustrations, state insurance departments are planning to implement updated rules concerning how carriers communicate policy projections.

No Need For Permanent Coverage

Indexed universal life insurance makes sense for someone who desires permanent life insurance protection. If your coverage needs are only for a certain amount of time, such as during your working years, look to term life insurance.

Ultimately, you will want to evaluate your life insurance needs, budget, and comfort level regarding varying interest crediting amounts – before giving a thumbs up or thumbs down on an IUL policy.

Pros Of Indexed Universal Life

There are seven primary pros to an indexed universal life insurance policy.

- Tax-advantaged cash accumulation.

- Permanent life insurance protection.

- Flexible premium payments.

- Adjustable death benefit and payout options.

- Safety measures in place to protect performance.

- Risk management features.

- Transparency of policy components.

Cash Accumulation

IULs provide the opportunity to safely accumulate tax-advantaged cash.

Your policy’s cash-value, once proper accumulation occurs, may be utilized in a number of ways:

- Policy loans to finance major purchases

- Policy withdrawals for retirement income

- Make the policy’s premium payments

Permanent Protection

Permanent life insurance lasts your entire life. Regardless of the age you die, your beneficiary will receive a death benefit.

In comparison, only a small percentage of term life insurance policies pay the death benefit, usually as the result of an untimely death.

Flexible Premium Payments

Your premium payments are not level. You have the option to adjust the premium amount you pay – based on your financial needs. Your premiums must fall within set parameters. If they do, payments can be decreased, increased, skipped, or stopped entirely, depending on the value of your IUL policy. Pertaining to skipping or stopping premium payments, you must at least meet the minimum no-lapse premium amount.

Adjustable Death Benefit And Options

Just like the flexibility of premium payments, your death benefit amount is also adjustable. If your financial needs change, you have the option to adjust the death benefit accordingly.

And, depending on the carrier, three modes typically exist for an IUL’s death benefit payment, similar to the following:

- Fixed

- Variable

- Return of premium

Safety Measures

Your IUL’s cash-value sub-accounts are protective in nature.

The indexed account’s floor safeguards the policy’s cash-value from loss.

And, fixed-rate accounts provide guaranteed growth.

Said differently, you will see cash-accumulation that is protected (or separate) from market downturns.

Risk Management

Risk management is in your control.

Often referred to as owner-controlled premium payments, you determine what sub-accounts your premiums enter, after policy fees.

For example, if you are risk-aversive, you may opt to place most of your premiums into the fixed account.

On the other hand, if you are comfortable with market volatility, you could place most of your premiums in the indexed accounts.

Transparency

If at any time, you would like to view your policy’s components, you are welcome to.

The policy’s components are unbundled. Unbundling provides policy transparency because it allows the policyholder to view and understand each specific element.

Elements include:

- Premiums

- Fees

- Interest

- Death benefit

Cons Of Indexed Universal Life

To be clear, there are potential downsides associated with an indexed universal life insurance policy.

Consider the following five concerns:

- More expensive than term life insurance.

- Fees usually increase with the policy owner’s age.

- If the stock market experiences a downturn, the credited interest may fall short of policy projections.

- Policy fluctuations necessitate varying required premiums.

- Policy cap restricts cash-value growth.

Cost

As you know, dollar for dollar, cash-value permanent life insurance is more expensive than term life insurance. Plan to pay significantly higher premiums for an IUL policy.

To compare, consider the premium differences between a $250,000 20-year term policy and an IUL policy for a 40-year-old male:

- 20-year term – $18.16/mo

- Indexed Universal Life – $141/mo

Fees

Policy fees do eat up some of your premium payments. Because there are a number of working parts to an indexed universal life insurance policy, you are charged accordingly. Remember, the four fees are premium load charge, monthly charge, annual fee, and mortality charge.

The mortality charge is especially worth noting because it tends to increase dramatically with age. Be sure to understand the fees associated with any given IUL, as they do vary, especially with newer products entering the market.

Market Downturn

Indexed sub-accounts do not have guaranteed growth. In fact, for most IUL policies, the minimum interest credit for an indexed sub-account is 0%, meaning that no money is lost.

However, fixed accounts are separate from market performance and will continue to have a modest interest credit. If the stock market experiences a downturn, and at some point, it will, the policy illustration used when you purchased your IUL is likely inaccurate.

Premium Fluctuation

Inconsistent premium amounts may be a godsend for some and a source of stress for others.

There are a number of factors that affect your IUL’s premium payments:

- Limits established by the life insurance company

- Performance of cash-value sub-accounts

- Policy fee amounts

- An IUL policy calls for active management.

Indexed universal policies require attentiveness, as opposed to ‘set it and forget it’ level term life insurance.” – Heidi Mertlich, No Physical Term Life

Policy Cap

While the policy floor protects you, the policy cap protects the carrier from paying out a significant credited interest for any given period.

If the market experiences a boom, you may not see the full benefit in your indexed account.

For example, if the market increases 18% in a crediting period, but your policy’s cap is at 10%, you will only be credited at 10%.

| Pros of Indexed Universal Life | Cons of Indexed Universal Life |

|---|---|

| Tax-advantaged cash accumulation | More expensive than term |

| Permanent life insurance protection | Fees increase with age |

| Flexible premium payments | Stock Market downturn affects performance |

| Adjustable death benefit and payout options | Policy fluctuations |

| Policy floor to protect cash-value | Policy cap restricts cash-value growth |

| Risk management features | |

| Policy transparency |

Best Indexed Universal Life Insurance Companies

Today, approximately 40 life insurance companies offer indexed universal life insurance policies. Your specific needs determine the best IUL carrier to apply with:

- Budget

- Goals for product

- Desired riders

- Health status

| Company | Issue ages | A.M. Best Rating |

|---|---|---|

| American National | 0 – 85 years | A |

| AXA Equitable | 0 – 85 years | A |

| John Hancock | 0 – 90 years | A+ |

| Lincoln Financial | 0 – 85 years | A+ |

| North American | 0 – 85 years | A+ |

| Penn Mutual | 0 – 85 years | A+ |

| Prudential | 0 – 85 years | A+ |

| Securian Financial | 0 – 80 years | A+ |

| Transamerica | 0 – 85 years | A |

With the help of an independent agent, the most important features to evaluate are:

- Available indices

- Index cap

- Index floor

- Fixed interest

- Interest bonus and multipliers

- Policy loan features

- Over-loan protection

- Available riders

The best life insurance companies for an indexed universal life insurance policy include:

American National

American National Insurance Company (ANICO) is a top IUL provider, especially because of the straightforward application process.

Sometimes, you can apply over the phone and skip the medical exam.

Date of founding: 1905

Headquarters: Galveston, Texas

Financial rating: A (A.M. Best)

Indexed universal life policies:

- Signature Indexed Universal Life

AXA Equitable

AXA Equitable conducts business worldwide. They are an ideal IUL provider for those nearing retirement.

Date of founding: 1958

Headquarters: New York, New York

Financial rating: A (A.M. Best)

Indexed Universal Policies:

- IUL Protect

- BrightLife Grow

John Hancock

John Hancock’s indexed universal life insurance products have performed well historically, and include generous additional features.

Date of founding: 1862

Headquarters: Boston, Massachusetts

Financial rating: A+ (A.M. Best)

Indexed Universal Policies

- Accumulation IUL

- Protection IUL

Lincoln Financial

Lincoln Financial is a highly-rated company offering strong IUL products.

Date of founding: 1905

Headquarters: Radnor, Pennsylvania

Financial rating: A+ (A.M. Best)

Indexed Universal Policies

- Lincoln WealthAccumulate IUL

- Lincoln WealthPreserve IUL

North American

North American, a member of the Sammons Group, offers a variety of highly-rated IUL products.

Date of founding: 1886

Headquarters: Des Moines, Iowa

Financial rating: A+ (A.M. Best)

Indexed Universal Policies

- Builder IUL

- Builder Plus IUL

- Guarantee Builder IUL

- Rapid Builder IUL

Penn Mutual

Penn Mutual, another top-rated carrier, provides two IUL products with beneficial features.

Date of founding: 1847

Headquarters: Horsham Township, Pennsylvania

Financial rating: A+ (A.M. Best)

Indexed Universal Policies

Accumulation Builder Choice IUL

Accumulation Builder II IUL

Prudential

Top-rated Prudential offers IUL products that perform well and offer competitive premiums.

Date of founding: 1875

Headquarters: Newark, New Jersey

Financial rating: A+ (A.M. Best)

Indexed Universal Policies

- PruLife Index Advantage

- PruLife Founders Plus

Securian Financial (Minnesota Life)

Formerly called Minnesota Life, Securian Financial offers a few strong IUL products.

Date of founding: 1880

Headquarters: St. Paul, Minnesota

Financial rating: A+ (A.M. Best)

Indexed Universal Policies

- Eclipse Accumulator IUL

- Eclipse Protector II IUL

- Value Protection IUL

Transamerica

Transamerica, one of the first carriers to offer indexed universal life, currently provides a one IUL option.

Date of founding: 1928

Headquarters: Cedar Rapids, Iowa

Financial rating: A (A.M. Best)

Indexed Universal Policies

- Transamerica Financial Foundation IUL

Riders

Riders are supplementary features of a life insurance contract, in addition to the death benefit. Familiarize yourself with the most popular riders offered with indexed universal life insurance to determine if any make sense for you.

Accelerated Death Benefit – Policy cash advances if diagnosed with a serious illness.

Accidental Death Benefit – Additional death benefit paid if the insured’s death occurs as a result of a qualifying accident.

Guaranteed Insurability Benefit – Option to buy additional coverage without the need to demonstrate insurability.

Long-term Care – Financial assistance should you encounter chronic illness.

Children’s Term – Term life insurance protection for your children.

Waiver of Premium – If total disability occurs, premiums are waived and the policy remains in force.

Note – The accelerated death benefit is typically included with your IUL policy purchase at no additional cost.

Bottom line

Rather than shopping for the ideal IUL company, we recommend shopping for your ideal broker.

Why? Indexed universal life insurance has a number of moving parts and it’s in your best interest to have someone sitting on the same side of the table as you, so-to-speak.

With access to multiple policy illustrations from multiple carriers, you can feel confident knowing you are buying the best policy to fit your needs.

See what you qualify for by answering some health questions.