Buy Term and Invest The Difference - (BTID)

Reviewed by

Grant Desselle

Licensed Insurance Agent

Reviewed by

Grant Desselle

Licensed Insurance Agent

Table of Contents

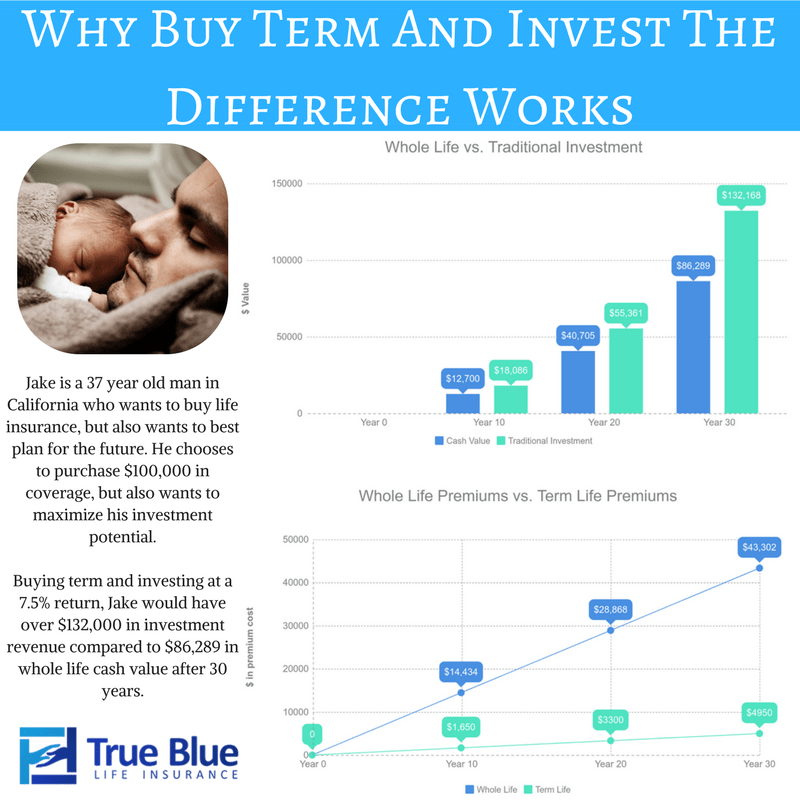

In our recent comparison of term life insurance vs. whole life insurance, it quickly became clear that term life insurance is 2 to 4 times cheaper than whole life insurance.

Is that large cost difference really worth it? Financial professionals like Dave Ramsey, Suze Orman, Brian Greenberg, and others don’t think so.

Instead, they recommend buying term life insurance and invest the difference, also known as “Buy Term And Invest The Difference,” or BTID for short. Investing the cost difference in various investment vehicles like mutual funds, index funds, and other such methods based on your overall investment strategy to maximize growth potential.

For those looking to make sure our golden years are indeed golden, life insurance stands as a major part of our estate and retirement plans. As threats of benefit reductions loom large to the Social Security system, millions of middle-class Americans are left questioning how they will fund dignified retirements. Using investment strategies like “buy term life insurance and invest the difference” can help ensure your retirement plans are safe and secure in sound fiscal principles.

Our family members rightfully depend on us for financial guidance and emotional support during our prime working years. Questioning how your family would adjust and survive without you and the income you provide is natural for those with minor children or a dependent spouse. The question becomes hard to ignore when we hit life’s major milestones.

A wedding, child’s birth, or the passing of a loved one all force us to answer the hardest of questions – what will happen to those I love if I unexpectedly die and how can I ensure their dignity without sacrificing my long-term goals?

See a few different scenarios of buying life insurance vs. saving

For decades cash value life insurance policies assumed major roles in both estate and retirement planning. The policies offer life insurance coverage that pays money to a designated survivor upon the insured person’s death. They also have an investment account attached to the insurance plan, and the proceeds of the investments can be used to pay premiums, buy additional coverage, or borrow against.

As great as they were when initially introduced, times changed, and term life insurance is now accessible for a fraction of the price of whole life insurance. A solid term life insurance plan costs between 10%-12% of what a comparable whole life insurance plan would cost, but it lacks the investment vehicle that made whole life policies so popular.

So with this new option to consider, what is the smartest approach to life insurance from an estate and retirement planning perspective? Is it better to buy a whole life insurance product or buy a term life insurance product and invest the difference between the term premium and a whole life premium? How can you maximize your legacy, protect your retirement, all while safeguarding your family in the meantime?

“Buy term insurance and invest the difference” is a strategy that grew in popularity because it will provide the typical American stronger returns, lower fees, and better coverage than a typical whole life or universal life insurance product. The process is simple enough. A person buys a term life insurance policy and pays a monthly premium. They then save an amount equivalent to the premium they would have paid with whole life insurance in a brokerage account that is intelligently invested.

Guessing how much money you can make off a given investment is a complicated process because return rates are far from certain, unlike death and taxes. We know that a well-diversified, index fund-based portfolio can be expected to return about 6% to 10% a year before taxes.

We recently compared the cost of term life vs. whole life insurance. The difference is huge. Look at the following two scenarios:

Scenario: Whole life

A 40-year-old male can expect to pay $347/month for a $250,000 whole life insurance policy. After 20 years, the policy will have a guaranteed value of $70,018, and its likely value would grow to $105,721 due to the performance of the investments held by the life insurance policy.

This increased value would boost the death benefit, the amount of money paid out to your family at the time of your death, to $326,352.

Scenario: Term life and investing the difference

In a 20-year- level-term plan, that same man could get the same $250,000 in insurance coverage for $23 a month. That’s $324 a month less than the whole life insurance product.

At a conservative rate of return of just 6% to 10% per year, the buy term and investment difference approach will produce a brokerage account worth about $150,322 to $248,327. That’s money accessible to you while you are still alive or to your beneficiaries if you pass away.

The difference in outcomes is enough to give pause to even the most conservative of investors.

Whether the “buy term and invest the difference” strategy makes sense for your specific situation depends on your goals and financial condition. A strategy that incorporates whole life insurance makes sense for Americans who may be subject to the estate tax, for example. For high net worth individuals, whole life insurance provides an effective way to reduce their estate size below the federal and state estate tax limits. Because the life insurance policies

Are not counted as part of a person’s estate, allocating a portion of your wealth to a whole life insurance plan can be an effective way to reduce your estate’s size by reducing available cash on hand while increasing your heirs’ inheritance through legally avoided estate taxes, probate fees, and the payment of a large death benefit. It isn’t an exaggeration to suggest that a few hundred thousand dollars invested into whole life insurance plans can save millions of dollars for those teetering on the cusp of the estate tax threshold.

Estate tax concerns impact a minimal number of people. According to tax policy advocacy groups, only about 5,400 estates will be subject to the estate tax in 2017. If you fear that you are in this select group, speaking with a tax professional about irrevocable life insurance trusts and the use of non-probate transfer mechanisms would be well worth your time. If you aren’t in this select group, it may still make sense to pursue a whole life policy if you are in another special circumstance.

If you have a special needs child or family member, a whole life insurance product held by an irrevocable life insurance trust can ensure a lifetime of dignified care for your family member without jeopardizing critical government-funded care. If your family history suggests that you will have costly health care expenses or complications that may burden your family or disqualify you from life insurance later in life, a whole life policy may be ideal for addressing final expenses and providing lifetime coverage.

A whole life plan also can be great for spendthrifts or those who can never seem to save money. If you find that you’ve had hard time-saving money and already invest in retirement accounts, whole life or other cash value life insurance plan can act as a forced savings account. Your monthly payments will build the policy’s cash value, and you will be able to tap into that money as it is needed later in life or during times of emergency.

As with most things, there are no absolutes in estate planning, and a blended approach that combines whole life and term life insurance can make sense for many people.

Still skeptical about the value of a “buy term and invest the difference” approach? Consider this: when buying a term policy, 100% of your premium payments fund your death benefit. That money is paid directly to whomever you designate with the insurance policy. The money is paid outside of the estate and is transferred tax-free. Because you aren’t directing any money to the savings and investment component that is heavily featured by whole life insurance, you can buy bigger death benefits for your loved ones.

How much bigger? A non-smoking 30-year-old woman in excellent health could likely secure a 20-year- term policy with a $1 million death benefit for about $480 a year. If she died at 49 and after paying just $9,120 in premiums, her beneficiaries would receive a tax-free payment of $1 million.

Term life insurance keeps things simple – it is an insurance product that pays out only when a loss occurs. If you never file a claim, you have nothing to cash out or get back. It operates in very much the same way as automotive insurance. If you are lucky enough not to claim your term life insurance, you can rest assured that you were paying a low price for peace of mind.

If you can’t stand the notion of throwing away money on an insurance plan that may never pay out, consider the opportunity cost. Investing the same $480 per year quoted in the example above into the stock market would only produce an account worth $25,960. If you were to die then, you’d leave your heirs with a nice inheritance. If you had term insurance in place, you would leave a legacy.

Dividend payments are one of the major advantages of participating whole life insurance products that are absent in term plans. These payments can be directed to pay the policy’s premiums, enhance coverage, or build cash value.

After the investment portion of the whole life policy reaches a certain threshold, the policy will essentially pay for itself and remain in effect forever.

Looking to replicate this benefit with a term policy? Imagine a 30 year fixed term plan that cost $45 per month in premiums. That would cost an insured party $540 per year. If you were to put $50,000 into a well-balanced bond or index fund, the dividends would likely cover the plan’s premiums until the policy terminated. When the policy expires, you would be left with the investment account and its accumulated growth.

If Alice in Wonderland taught us anything, it’s that the way to arrive at an objective depends entirely on where you want to go. Whole life insurance offers several advantages that are highly appealing to investors. The policies have a shallow degree of volatility associated with them. They are predictable – you know what your policy will be worth and what you can cash it out for at any given time. As long as you pay the quoted premiums on a timely basis, you will have a policy that is worth the sum stated on the cash value table. In a sense, whole life insurance totally immunizes you to market risks, and you can rest assured that your whole life policy will not dip 20% in a single month because of a bad earnings season.

If your goal is tax avoidance and minimization, whole life insurance can be precious. It is easy to shelter a growing investment from capital gains taxes, pass money to heirs outside of an estate that may otherwise be exposed to estate and probate taxes, and borrow against money to avoid paying taxes at the time of withdrawing.

If your goal is overall economic efficiency and to make the most of what you have, then the “buy term and invest the difference” approach works best. Disciplined investors recognize that there is no such thing as a free lunch. They know that insurance companies are willing to guarantee returns because they know that they can beat those guaranteed returns by investing the money themselves. By cutting out the insurance company as a middle man, the investor can avoid high fee investments and management fees, get better returns, and keep more money.

Estate planning and saving for retirement are two goals that can be achieved simultaneously. If you’ve found yourself questioning how to provide for the long term care of your family, maximize tax advantaged saving, and hit those essential retirement milestones, you’ve likely questioned whether cash value life insurance or term life insurance is better suited to support your needs.

If you are in an exceptionally high tax bracket, are facing uncertainty as to your physical condition over time and want the stability of a permanent life insurance plan, are maximizing other tax advantaged savings and investment accounts, or are looking for a way to reduce estate tax exposure, it is possible that a whole life or other cash value life insurance plan makes sense for you. While these policies are more expensive than their term life equivalents, their favorable tax treatment and ability to become self-supporting through the payment of dividends can make them an attractive option for people interested in legacy planning, providing long term support to family members, or charitable giving.

If one of these special considerations don’t apply to you, a strategy of buying term and investing the difference likely sets you up for the best possible outcome. Your family will be protected by the term life plan while you gradually build wealth in open market investments. You will avoid fees that are often associated with cash value insurance products and will have a high level of control over your investment strategy. The only caveat to this strategy is that it requires a disciplined investor who consistently sets aside money in well selected accounts and it forces you to accept that if your health condition deteriorates before you either purchase or renew a term policy, you may not be able to secure reasonably priced insurance.

Generally speaking, the strategy of buying term and investing the difference offers better returns, lower fees, and more control. It is a ideal strategy to consider as part of your estate and planning process.