Best Car Insurance for Drivers with Bad Credit

Bad credit can be a burden. It is used to gauge your financial capability and responsibility. Hence, it affects many aspects of our lives, including car insurance.

If you are a driver with a poor credit score, expect to pay more for auto insurance. This does not mean that lenders are being unfair. Instead, they are trying to be safe given your financial history’s risks.

Table of Contents

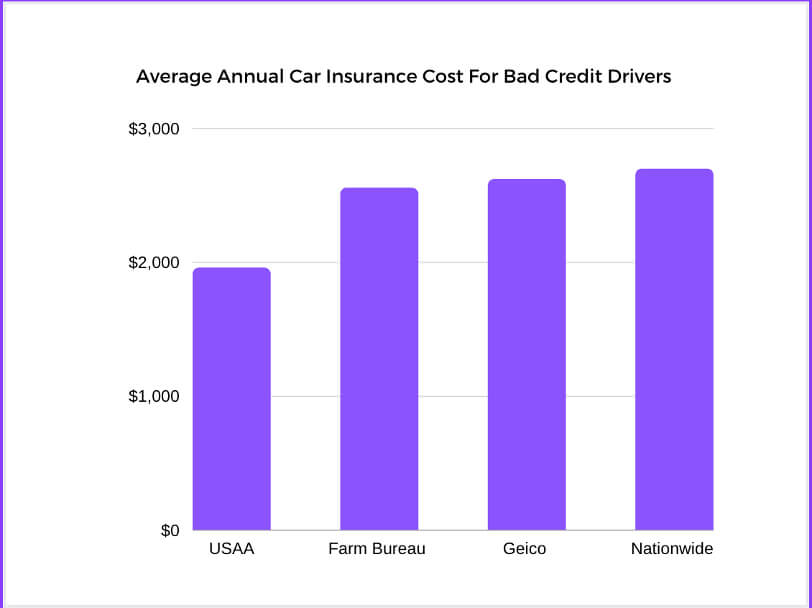

Based on our analysis, USAA, Farm Bureau, Geico, and Nationwide are four companies with the cheapest car insurance premiums for people with bad credit. The table below summarizes the annual rate from each of these providers.

For reference, when we say bad credit, it refers to a credit score that ranges from 300 to 579. Our analysis showed that you can pay a premium up to 70% higher than those with average credit. Nonetheless, the specific amount will depend on other factors, such as the state where you live and driving records, among other things.

If you have bad credit, the best way to buy car insurance is to shop around. Do not be in a rush to find the right policy. The first company you find may give you high premiums, but do not give up.

The best thing that you can do is to go online and look for a car insurance comparison website. For instance, Assurance IQ Auto Insurance allows a comparison of up to 15 carriers, providing a snapshot of the possibilities worth considering.

Also, to get the best deals on car insurance, consider all the possible deductibles to bring down the premium. It might also be a good idea to get your home and car insurance from the same company, which might make you eligible for a discount.

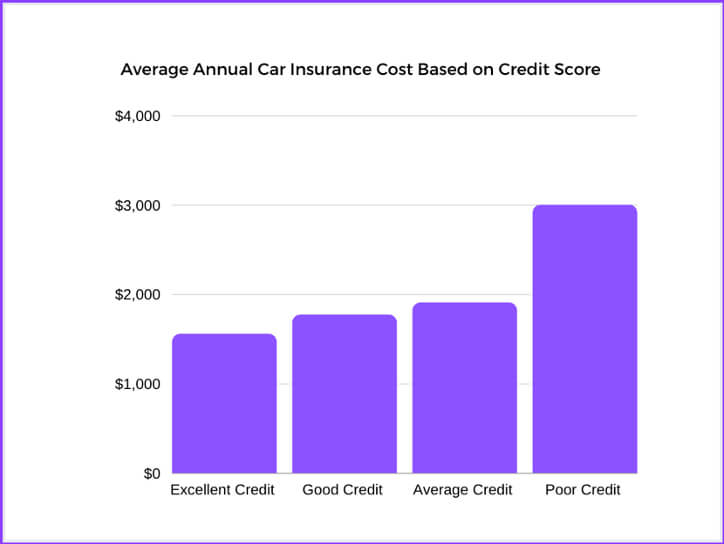

As you can see in the table below, there is a slight difference in the cost of car insurance if you have Excellent Credit ($1,550, Good Credit ($1,770), and Average Credit ($1,900). The biggest difference, however, is when it comes to Poor Credit, wherein the premium for car insurance jumps to $3,000. That is up to 50% higher compared to the rate for drivers with Excellent Credit.

In one study by the Federal Trade Commission, the researchers have proven the correlation between a driver’s credit score and the cost and frequency of car insurance claims. With this, insurance companies perceive drivers with bad credit as higher-risk individuals. Since they are likely to file a claim, their premiums are higher.

Bad credit does not necessarily have to translate to an excessive premium. With a proactive approach, you can lower your car insurance rates. Below are some of the best things to do:

California, Hawaii, Massachusetts, Michigan, and Washington all ban the use of credit scores in determining an individual’s car insurance premium. Instead, they focus on driving records and other factors beyond a person’s credit standing.

Your car insurance rates can decrease if you improve your credit score. However, take note that it does not happen overnight. Credit reporting bureaus can update your score on every request, provided that there has been a change in the factors affecting your report. It can take several months or even years, so you must be patient.

No, applying for auto insurance has no impact on your credit rating. Even if you apply to multiple insurers to compare quotes and find one that is most suitable for you, it does not impact your credit score. Also, car insurers do not report to credit bureaus, so your premium payments will not appear on a credit report.

Unfortunately, most major car insurance companies use credit standings to evaluate premiums. There are only very few that won’t, but most of them are uncommon and local, such as Dillo in Texas and Cure Auto Insurance in Pennsylvania and New Jersey.

The only instance where major car companies won’t look at your credit is when you are from a state that does not allow using credit reports for insurance.

It depends. Most of the weight will be on your driving performance, but most of them will probably still look at your credit score as they decide on an initial premium.

In sum, having bad credit can be a nightmare for some drivers. It could translate to a higher car insurance premium. Insurers will see you as a higher risk. However, some companies are offering exceptional premiums for drivers with bad credit. USAA, Farm Bureau, Geico, and Nationwide have some of the cheapest rates for drivers with poor credit scores.